The main two marine insurances are, Hull & Machinery (H&M) and the Protection and Indemnity insurance, or as it is more commonly known - ‘P&I’, which is covering crew, cargo and third party liabilities. P&I insurance steps in if third party claims are brought against the shipowners. Shipowners provide a service of carrying the cargo of the shipper. While providing this service, a shipowner may be subjected to a number of claims from either cargo interests or third parties.

Shipowners are obliged to insure against such liabilities and P&I Clubs provide cover for all the aforementioned claims.

Before the 19th century, the term “marine insurance” only meant the insurance for the ship’s hull and machinery. This was the time when most of the ships were sailing vessels. The risk of collision between two sailing vessels was significantly smaller than it is today. But as more and more steamships came to the sea, the chances of collision between ships in-creased. Underwriters became concerned about this increased risk. Rightly so because in collisions between two vessels, H&M insurers not only have to cover the damages of the insured ship but also pay for the damages of the other ship if the sole responsibility for the collision lies with the insured vessel.

In order to ensure that shipowners do not claim small amounts and have increased interest to minimize casualties and claims deductibles are in place.

P&I deductibles range from € 3.000,- to € 11.000,- depending on vessel size and type of claim (crew / cargo / third party).

Deductibles for claims are a commonn practice in all kinds of insurances. The deductible is the pre-set amount deduct-ed from the insured loss which the assured has to pay from his own pocket.

Assuming that a P&I Club has set the deductibles for claims arising from damage to a jetty at USD 5.000. Now if the claim towards the shipowners for one of such incident is USD 30.000. Then the P&I club would pay USD 25000 after USD 5000 as deductible from this claim.

The coverage of the P&I insurance includes following aspects:

- Personal injury / illness / death of the crew, stevedores, passenger, etc.

- Collision Liabilities not covered by Hull and Machinery Underwriters

- Wreck removal

- Damage to fixed and floating objects

- Pollution; Typical claims arising out of pollution

- Liability for loss, damage or contamination

- Clean-up costs

- Preventive measures

- Costs of complying with Government directions

- Salvor’s compensation for pollution prevention

- Cargo damage/shortage; The cargo itself is not insured, but the Club covers the member for liabilities to cargo owners:

- Cover for liabilities arising out of loss or damage to cargo

- Cover for disposal costs of damaged cargo

- Cover for third party bunkers e.g. charterer’s

- Cover for cargo’s proportion of GA

- Fines

- Stowaways

- Covers costs of repatriation

- Additional costs for security

- Pre and post departure stowaway checks

- Costs of accommodating stowaway

- Costs of emergency documentation

Due to several reasons like Brexit, huge losses on the London Lloyd’s Market, premiums, etc. Briese Shipping had to change the insurances in the last months from time to time also in the P&I sector and therefore we are working currently with the P&I Clubs West of England, Skuld and The Swedish Club. All mentioned Clubs have a strong back-ground and are improving the performance all the time.

To have a better loss record and to minimize the risk of cargo damages, the P&I Clubs require a so called „P&I condition surveys“ after a change of P&I Club.

Especially older vessels will be chosen for such surveys, but generally the complete fleet has to carry out the sur-veys accordingly. Mainly the water tightness of hatch covers is in the focus of surveyors, which will be checked by ultrasonic or hose tests. But additionally it will be checked whether fire pumps, mains and monitors are in apparent satisfactory condition, as well as accommodation, pilot ladders and gangways etc.

Below pictures show some defects which have been announced by a surveyor.

A few days after the survey a respective report will be issued, with or without a „list of defects“, which should be processed and deleted within a few weeks.

As mentioned before the main focus lies on the water tightness of the hatch covers, which P&I cover can be suspended after a negative result of ultrasonic or hose test, especially in view of sensitive cargoes. Of course additional support of ramnek or expanding foam is wel-come, but 100% water tightness should be given without same anyway.

In this context we have to refer to the pre-loading sur-veys as well. The P&I Clubs have been convinced to accept our known internal pre-loading surveys, which have to be

ca rried out by our crew. Consequently a lot of money and time was saved in the past as no external parties were necessary anymore. Of course, from time to time charterers customers require such an external survey, but these costs are not for our account.

However, the results and experiences of the last months show that all crew members did a very good job according to the P&I condition survey reports and pre-loading surveys.

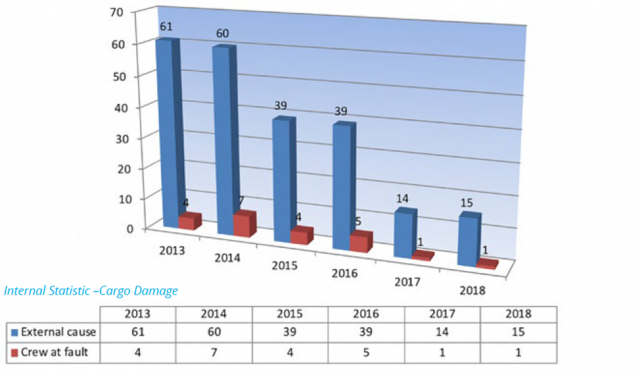

The statistic below, illustrates how the number of cargo damages on board our vessels has decreased consistently by a factor of 4 over the last couple of years. We attribute this decline not least to improved crew performance in maintaining vigilance during cargo operations.